Intrinsic Insights:

Articles | BALASTONEUnconventionally Faithful to the Principle of Investment

At BALANSTONE, we ensure process by merging data-driven insights with a steadfast commitment to intrinsic value philosophy. Our unique approach uses rigorous, long-term research grounded in both advanced data analytics and timeless investment principles. This blend enables us to take a strategy through a long investment journey under evolving landscapes.

Our research explores diverse investment topics, from historical principles and empirical lessons to the latest trends, all analyzed through a data-driven lens. By focusing on intrinsic value and rigorous fundamental analysis, we spot undervalued assets and pursue growth opportunities with patience and precision.

Screening in the Context of Long-Term Fundamental Investment and Research

Introduction Screening has long been a cornerstone of the initial pipeline of invest process, enabling investors to shift through vast datasets to identify potential opportunities based on specific characteristics such as value, momentum, and quality....

Market Timing in The Context of Long Term Fundamental Investing

Market timing is alluring but fraught with risks. Discover how long-term investing strategies, supported by data-driven insights and lessons from Graham and Buffett, offer a more sustainable path to wealth creation. Learn how margin loan reversals and strategic patience play a pivotal role in navigating market cycles.

Investment Time Horizon: The Strategic Core of Portfolio Management

Investment time horizon remains a significant strategic element in investment and research process and philosophy but there are many cases that lack appropriate understandings.

The Importance of Quality in Free Cash Flow for Valuation

Free Cash Flow (FCF) isn’t just about the numbers—it’s about quality. Discover how adjustments for acquisitions and stock-based compensation uncover a clearer picture of financial health, helping investors balance theoretical valuations with market conventions.

AI Infrastructure Investments: Real-World Applications and Long-Term Value

AI infrastructure is more than a cost—it’s a transformative investment. From Salesforce’s Einstein to ServiceNow’s customer service automation, discover how leading companies are using AI to deliver real-world value and set the foundation for future innovation.

Transformer Deep Learning Architecture

Jimmy: "Transformers have revolutionized not just natural language processing but entire sectors. By parallelizing computations instead of relying on sequential processing, they've dramatically sped up training times and opened new frontiers in AI...

Navigating the Generative AI Revolution in the IT Landscape

Katy: "Have you seen the impact of generative AI technologies lately? OpenAI's ChatGPT is now ranked 20th globally. It's incredible." Alan: "Absolutely. But the real challenge lies in scaling these technologies cost-effectively. The entire IT infrastructure...

Snowflake

Analyst 1: Snowflake's business model strategically aligns with the massive shift towards cloud computing, emphasizing the necessity for cloud-native data warehousing technologies. This approach...

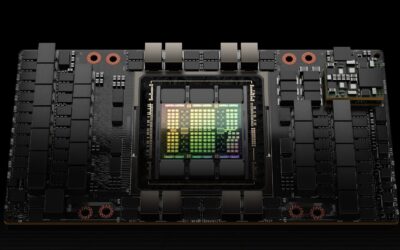

AI Inference Technology: The Role of Sparse Networks and Hardware Innovations

Dive into the competitive landscape of AI inference technology, where companies like NVIDIA, Samsung, Apple, and Qualcomm leverage sparse networks and specialized hardware. Learn about innovations in architectures like NVIDIA’s Hopper and Ampere, and their impact on the future of AI.