Intrinsic Insights:

Articles | BALASTONEUnconventionally Faithful to the Principle of Investment

At BALANSTONE, we ensure process by merging data-driven insights with a steadfast commitment to intrinsic value philosophy. Our unique approach uses rigorous, long-term research grounded in both advanced data analytics and timeless investment principles. This blend enables us to take a strategy through a long investment journey under evolving landscapes.

Our research explores diverse investment topics, from historical principles and empirical lessons to the latest trends, all analyzed through a data-driven lens. By focusing on intrinsic value and rigorous fundamental analysis, we spot undervalued assets and pursue growth opportunities with patience and precision.

Japan Demographic Trends: How Shrinking Birth Rates Are Reshaping the Economy

Explore how Japan’s declining birth rates (1.1, 1.25, 1.4) and aging population impact GDP growth, inflation, labor markets, and policy. Learn about the potential for automation, changing labor dynamics, and economic strategies shaping Japan’s future.

Investment Analysis of DeepSeek | How Low-Cost LLM Strategies Impact AI Hardware

In this thorough investment analysis, we examine how DeepSeek’s low-cost approach to training large language models both disrupts pricing and underscores the continued need for advanced HPC. From Mixture-of-Experts to quantization, discover why early-stage AI efficiency gains often drive more hardware usage, not less.

DeepSeek Debate FP32 to FP8 and Video Compression

We compared the progression of AI compute migration from FP32 to FP8, DeepSeek’s one of the features with the video file technologies history. We focus on the implications of infrastructure, including the impact on memory and processors, and the debates regarding the efficiency gains and cost advantages that have enabled increased capacity to handle growing demand. This analysis is particularly relevant in the context of the recent debate over DeepSeek’s technology and its impact on the AI landscape. The analytical approach to understanding a dynamic ecosystem is crucial for fundamental long-term investment and research, avoiding speculative noises, and recognizing the potential for secular and dynamic growth sectors.

Agentic AI: The Next Frontier in Autonomous Reasoning

Discover how Agentic AI addresses data scarcity, leverages diverse multimodal datasets, and transforms industries like healthcare through iterative reasoning and autonomous capabilities. A must-read for investment professionals seeking high-value opportunities in AI’s next evolution.

Trends in Database Technologies: Insights from Research Analysts

An in-depth dialogue between equity research analysts John and Sara, exploring the latest trends in database technologies, including ad-hoc filtering, horizontal scalability, instant data freshness, and the impact of Lambda and Kappa architectures on AI and machine learning applications.

Unlocking the Power of Long-Term Investing: Lessons from Robert Kirby’s Coffee Can Portfolio and Beyond

Robert Kirby’s classic concepts in ‘The Coffee Can Portfolio’ and ‘More Than Numbers’ reveal how long-term patience and high-conviction investing can drive enduring wealth. Kirby’s philosophy offers invaluable insights for investors seeking value beyond short-term metrics, advocating low turnover and a disciplined, compounding-based approach to investing.

Generative AI Investment Challenges: Navigating Data Quality and Investor Skepticism

Generative AI is revolutionizing industries, but investor skepticism is mounting due to concerns over data quality, scalability, and ethical considerations. In our latest article, we delve into these challenges and highlight the innovative solutions—like synthetic data generation and retrieval-augmented generation—that are driving the industry forward. We explore how a balanced market perspective fosters healthy debate and sustainable growth, ensuring that generative AI reaches its full potential. Discover how the intersection of technology and financial market, where investment is rather rationalized in the long run through embracing balanced views toward generative AI investment challenges.

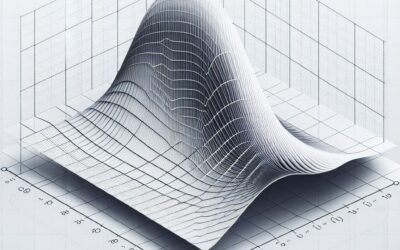

Reducing Investment Risk: The Power of Long-Term Growth Investing

Discover how long-term growth investing can reduce investment risk and enhance returns. This article explores empirical evidence and strategies that optimize return per risk, challenging traditional short-term risk management approaches.

Rethinking the Investment Process Pipeline

Emma and James, two seasoned investment professionals, meet in their firm's conference room overlooking the city skyline. With coffee cups in hand, they delve into a critical discussion about the issues and effectiveness of traditional investment...