We have made a note on inflation five years ago. We think it is time to update the data and charts and check how they look like.

For the recent inflation debate, we use the data reported by Bureau of Labor Statistics and share our impressions.

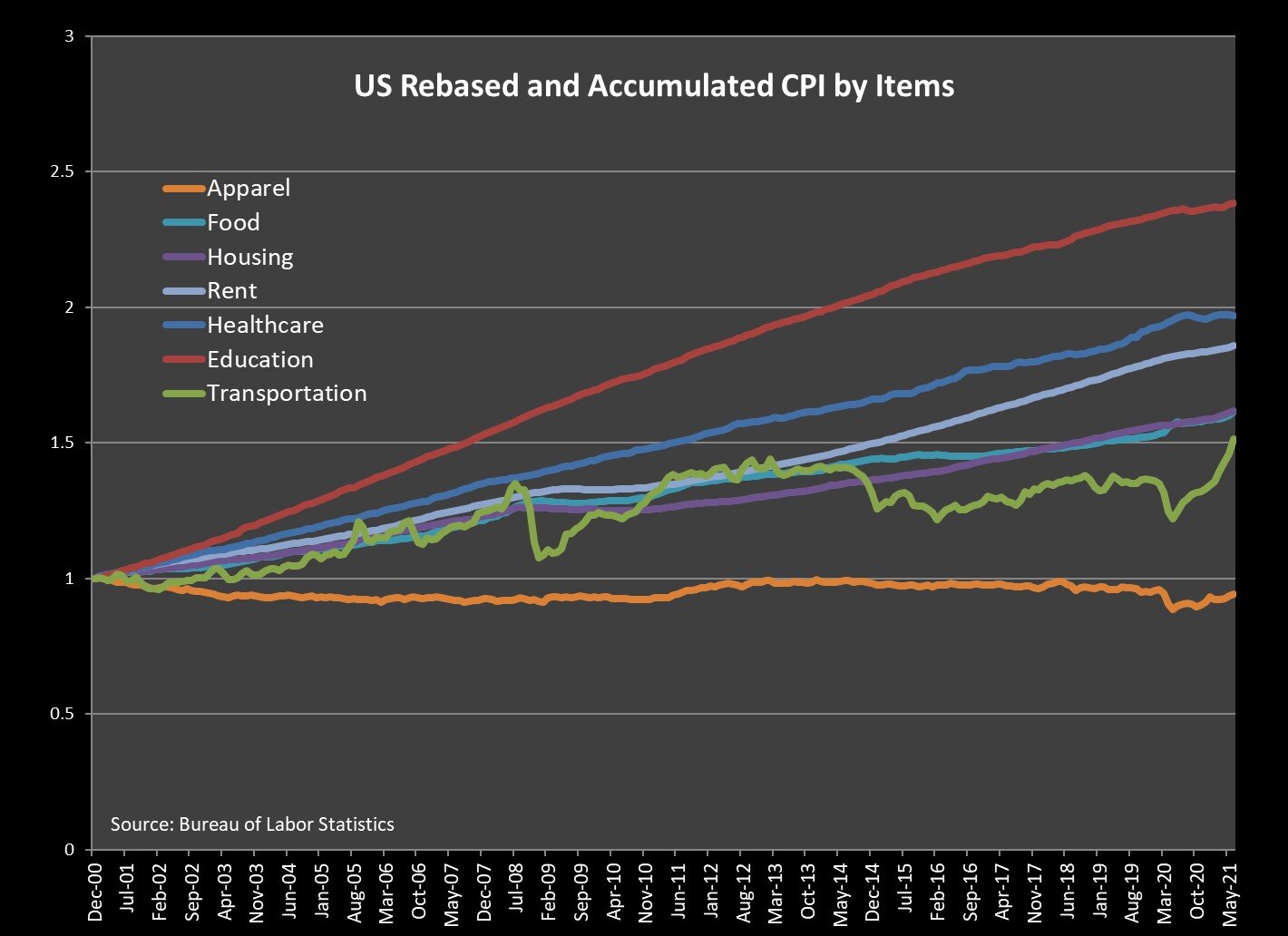

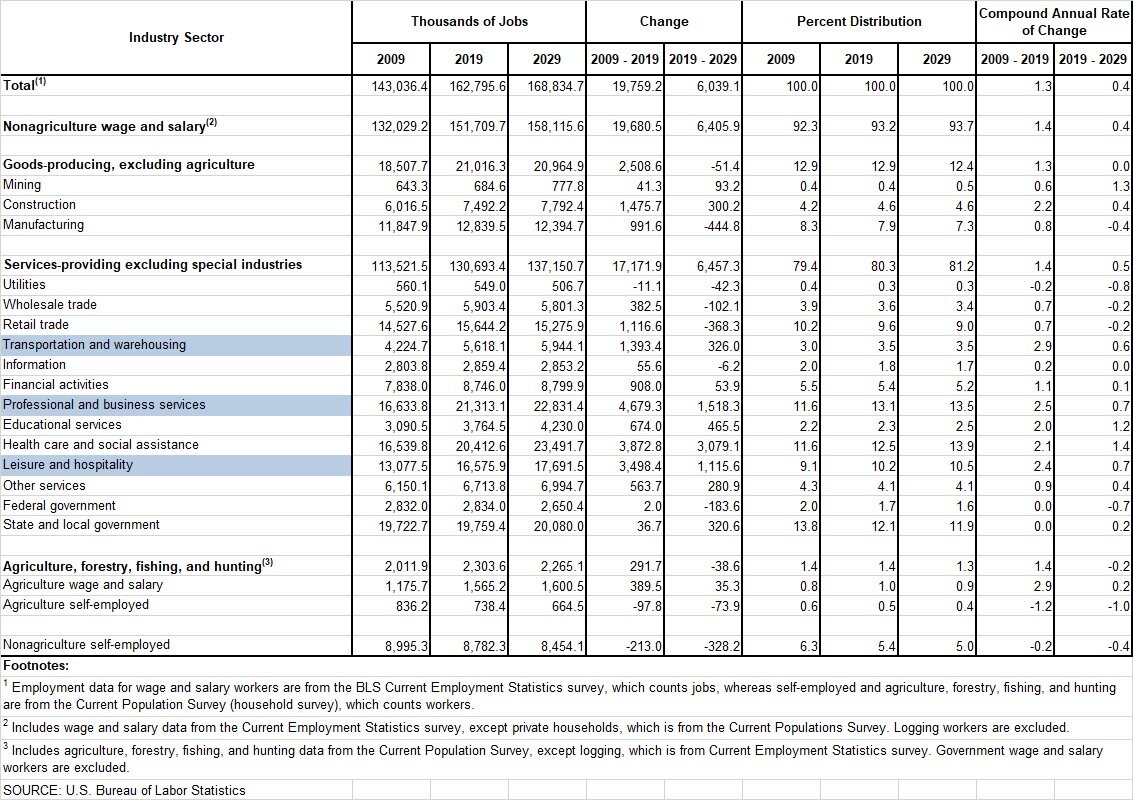

First, on the latest CPI figure and the debate of “transitory” or “persistent” inflation, the table below is the latest monthly CPI breakdown by items since last year, and I selected the ones with the highest contribution to the overall inflation.

I also highlighted them to classify the common factor among those high contributors. As can be seen from the table, it is obvious that both the last year’s low base effect and this year’s environment where people are getting to “normal” after immunized against the risk of getting the severe illness of COVID.

The idea we need to think about is how they will look in 2022, or 2023. Just like in 2020, when things are just in front of the market, the market tends to lose thoughtful and careful imagination. Always it gets biased by the incidents nearby in time.

That has helped survival as the alarm of instinct by the degree of distance should get prioritized to avoid encountering risk events. That is in DNA.

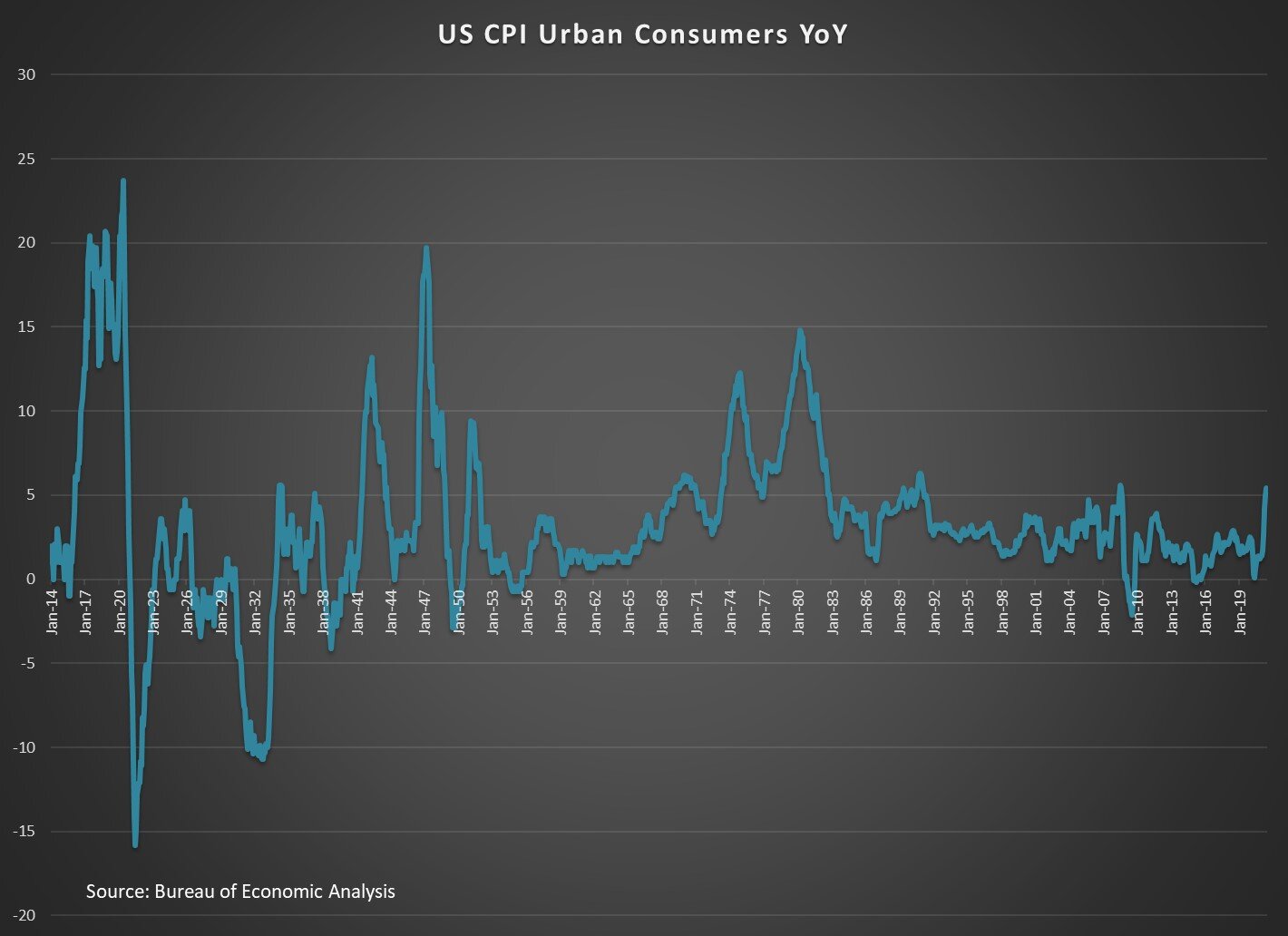

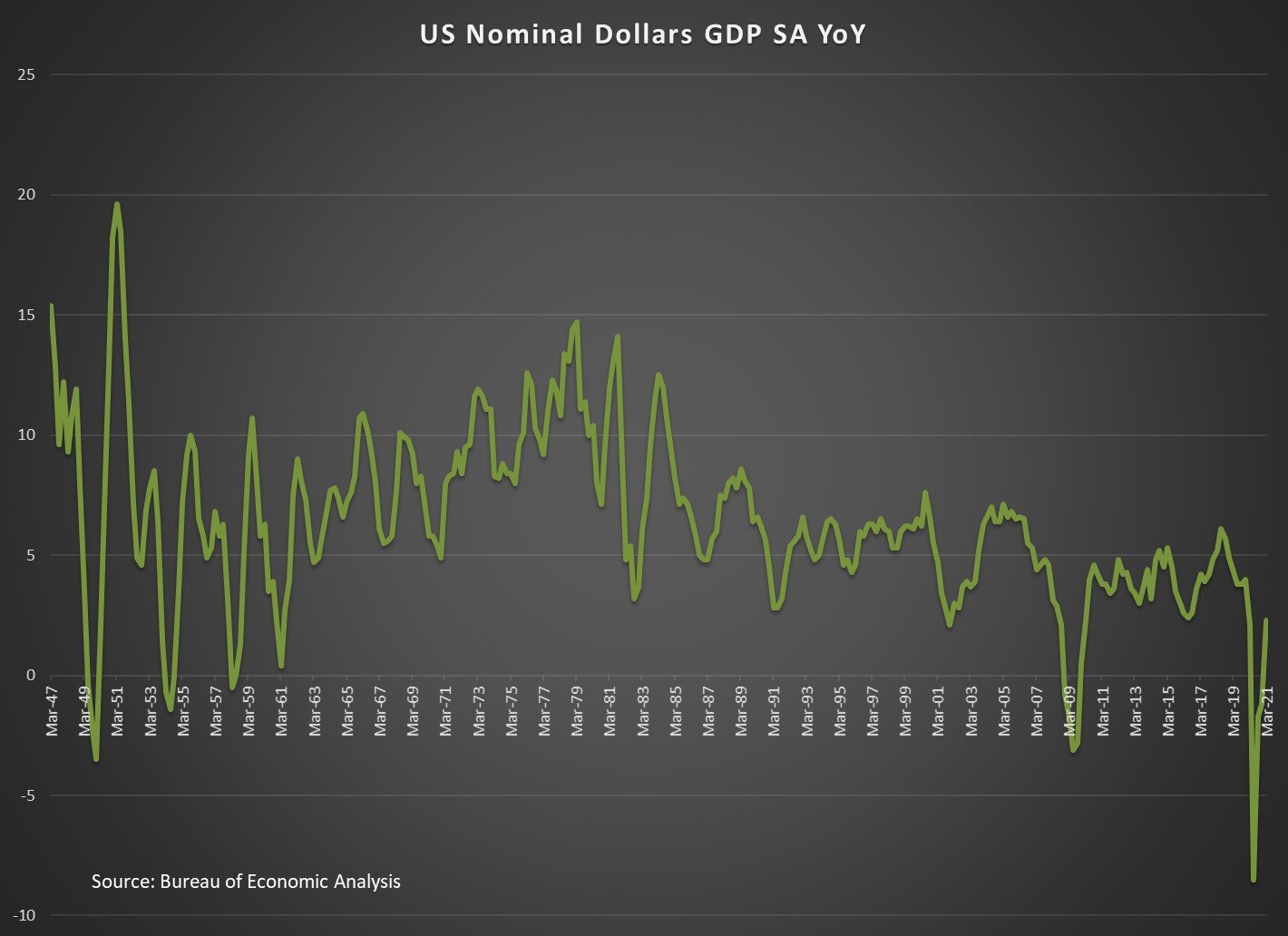

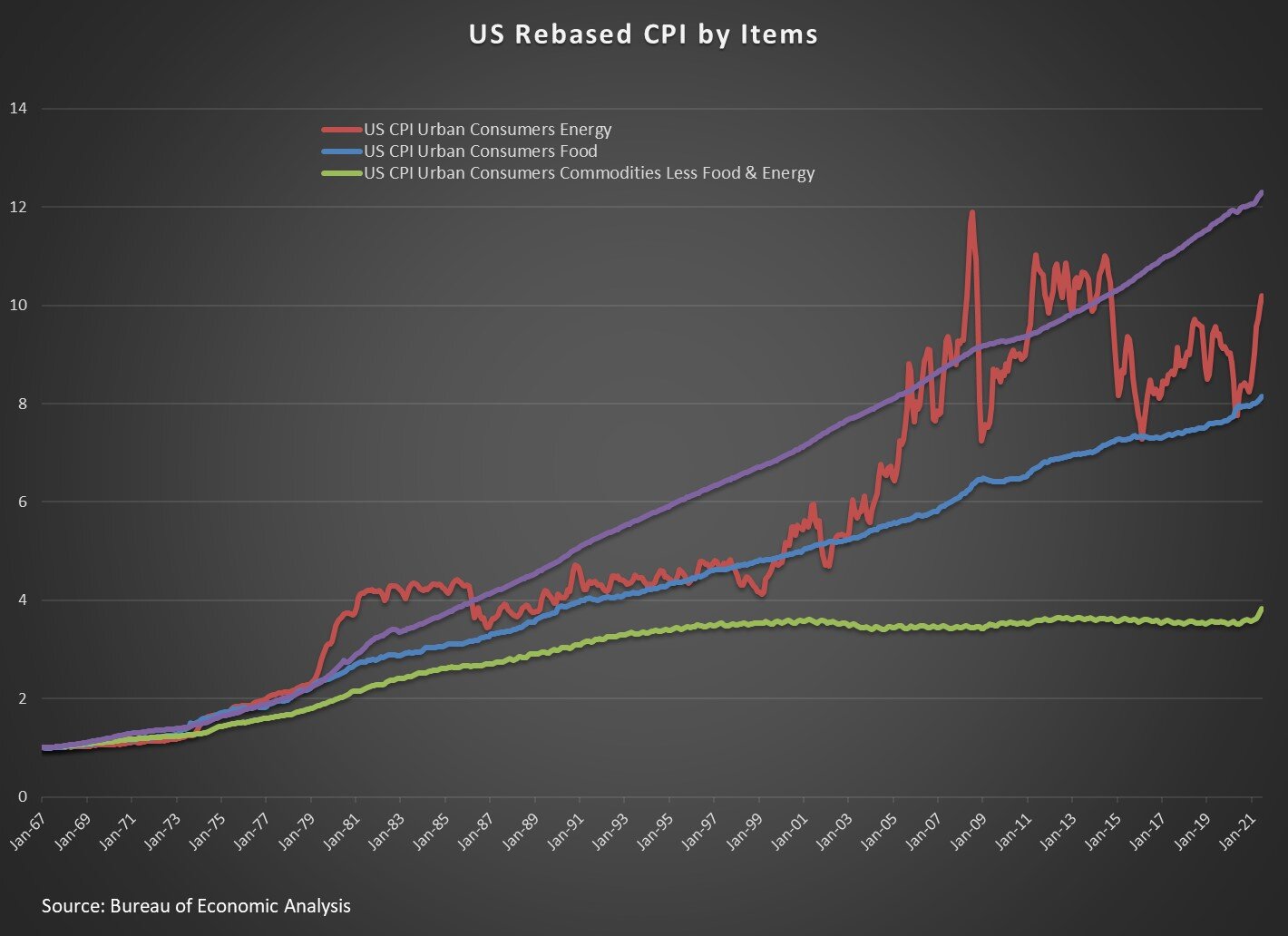

I also present the charts on my previous note on inflation below, and they look somewhat different but the implications from them are pretty the same and my views remain unchanged.

In the last century, we had significant growth of the human population in many countries. It led to rapid economic growth in human history with different timing throughout the last century. That was quantity-driven structural growth, spreading over diverse areas and segments of the economy and society. As such, a traditional economy model could explain more successfully various economic markets.

Now we are heading to a new reality. The human population in the world will not grow as fast, and the value-added will need to get generated out from advancing intellectual assets.

I feel somewhat strange about the fact many are still trying to apply a traditional macroeconomic textbook-style approach, knowing that it has not explained many dynamic phenomena we are accustomed to.

One thing that seems clearer is that spending too much time on the macroeconomy will not help much to deliver superior and consistent returns from investment. Much more great investment (not trading) ideas have been generated from somewhere else.