Why do we, the investment professionals, ask what causes inflation and need to get equipped with an accurate idea of the long-term trend of inflation?

As the decline in the cost of capital has had a strong influence on the discount rate for future excess return, the long-term views on inflation cannot be dismissed to clarify the spread of cross-asset valuation.

Secondly, with the long-term perspectives in mind, the short-term variability of reported and expected inflation, mainly due to noises of news-flow or nervous spirits of the market, will get managed in the appropriate context, depending on the investment strategy of the firm or the investment team. It is a powerful exercise.

History of Inflation

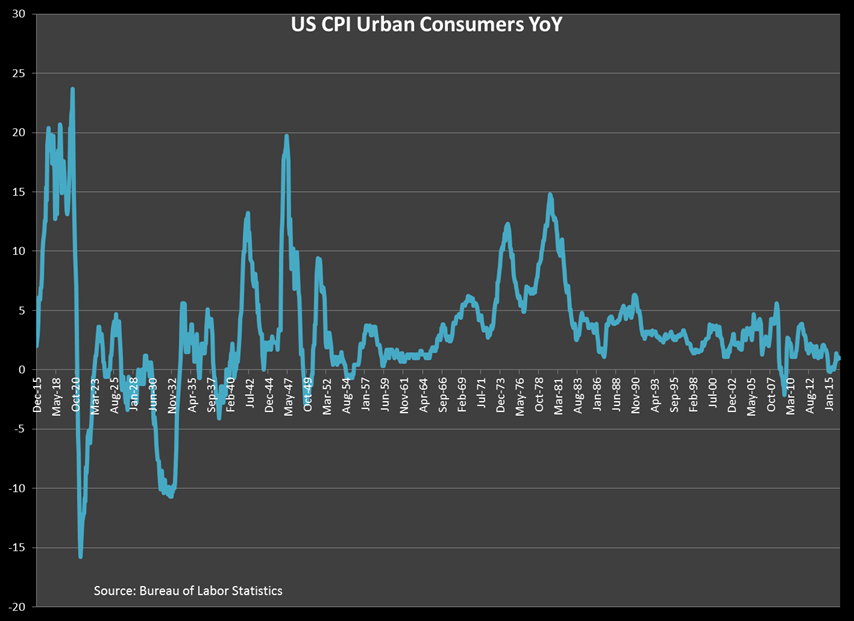

For the last 25 years, inflation has been trending around 2-3 percent on average, and it was down to 1.39% post-financial crisis period.

Although between 2000 and 2007, there was a small pickup, it has been in a moderately declining range since the 80s. To that small pickup, I believe that a transient increase in excess credit and financial leverage contributed to it. They are no longer a driving factor, as the economic backdrop that allowed excess financial leverage has changed. Thus, the trend seems to have shifted and back on the natural trajectory.

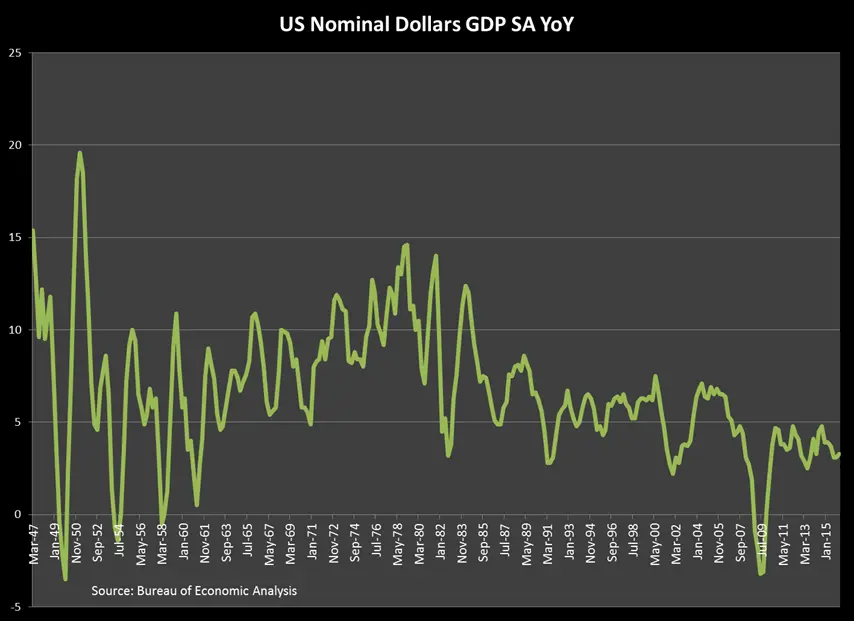

It is not surprising to note that nominal GDP growth has been moderating similarly since the early 80s. They indicate that a common, persistent, and influential macroeconomic factor has worked to move both of them in the same direction.

We believe that it is more reasonable to stick to a prospect that the historical trend is a predictable guide rather than forecast a change that has not occurred for long, just because the rate is too low.

The federal reserve has got forced to raise it to have an insurance of potential rate cut in contingency. In other words, we think it is fair to assume that a common and some important secular factor has shifted and turned a corner in the US around the mid-end of the 80s, and the trend remains since then.

The prospect of accelerating inflation sometimes gets attention, as temporal fluctuations of reported inflation occur. However, it is a normal variability around the new secular trend. It is not a sign of returning to the old trend under the economy of the 80s. Allowing a stimulus of “the dark side” excess financial leverage and complicated credit to boost inflation is also unlikely. In fact, it failed the economic system, and that is why inflation remains low.

Second, bottom-up inflation gives a more detailed picture of inflation. While monetarists argue that inflation is a result of the money supply, it cannot explain the variations of inflation among various products and services. In fact, it is those variations that give the right perspective to make investment judgments with a careful understanding of the long-term trend.

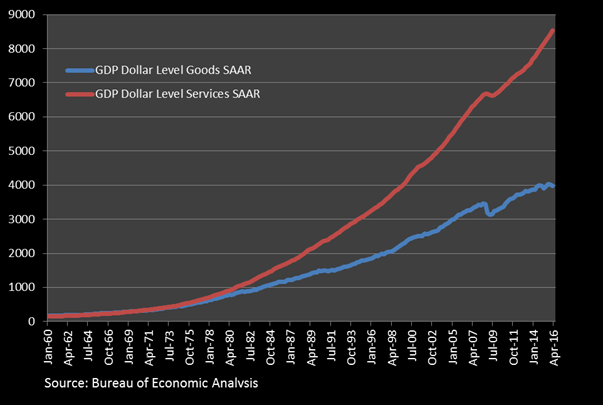

While the aggregate inflation figures, which we see often, have been moderate since the 90s, higher inflation has been delivered from the services than the goods.

If we did not have a shift toward the service-oriented economy, the inflation would have been lower. To predict the future inflation trend, it is not unreasonable to ask if the general price of services will still rise faster or if the cost of goods will bottom out and rise.

When did the price trend divergence of goods and services start? Both wheels grew at the same pace until when GDP growth trend changed its course. Since the mid-80s, the paths of the two have begun to diverge.

And why? I am not an economist, but I have my views, which I am looking forward to sharing. Still, please get in touch if you are interested further in this topic.

Industry Bottom-Up Perspective

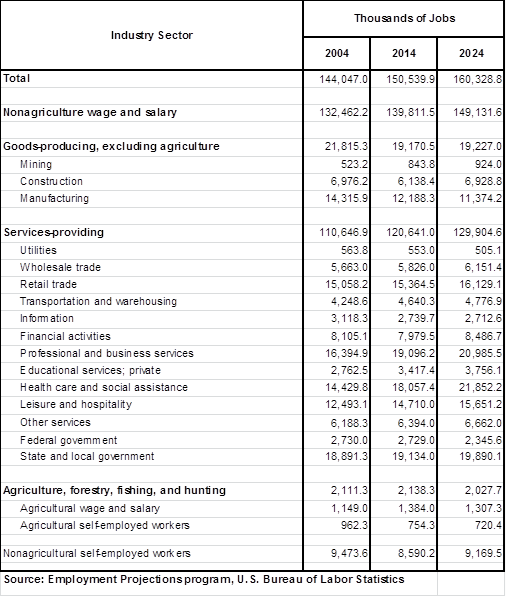

When looking at it from a different angle, for instance, the industry mix measured by employment, the manufacturing industry has decreased employment from 18 million in 1990 to 12 million in the latest figure. It is projected to decline further to 11 million in 2024, according to the US Bureau of Labor Statistics. On the contrary, the high value-added service industries defined by the total of Healthcare, Professional Services, and Educational Services grew to just below 55.1 million from 41.7 million. That helped the US dodge the dis-inflationary trend spreading in the developed economy outside of the US.

What does the bottom-up inflation by items indicate?

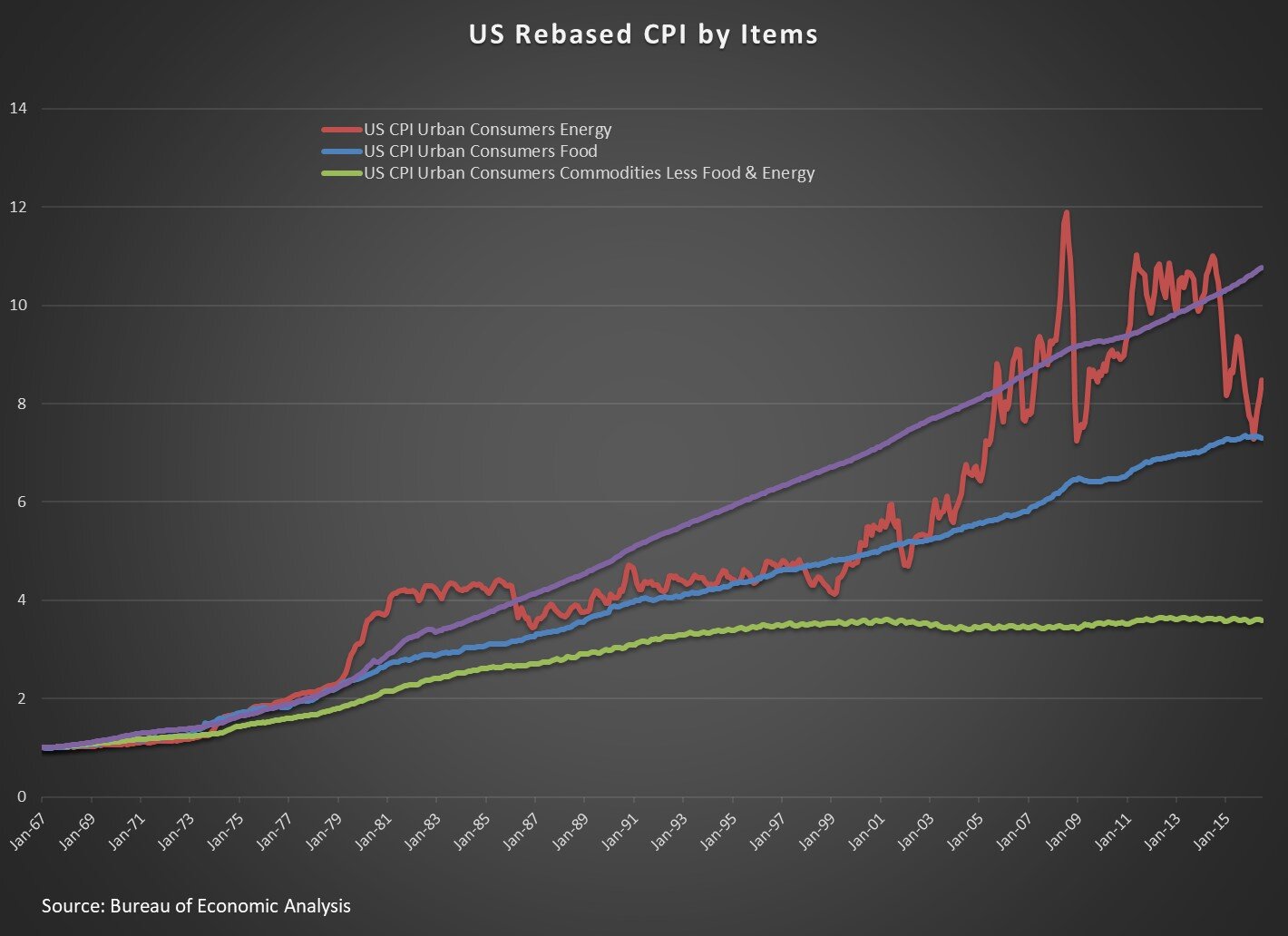

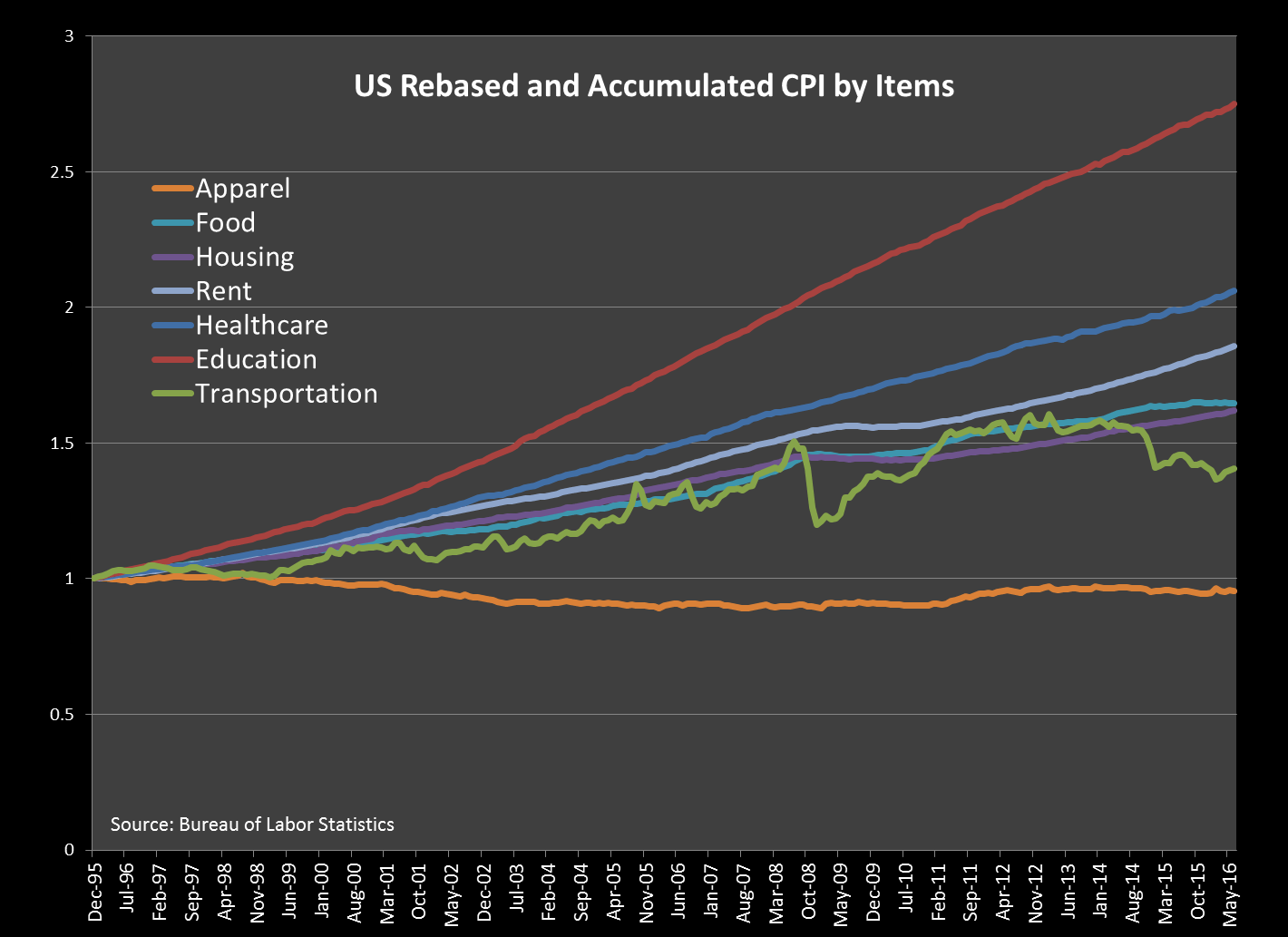

Below is two charts that describe the rebased & accumulated price trend from 1967 and 1995.

Several observations can be obtained from these graphs. First, education and healthcare were the leading long-term inflation drivers, while consumer goods such as apparel have been the leading drivers of disinflation.

Second, energy price has had short-term impacts with high volatility. At present, it is just settled at the equal level of the accumulated inflation of foods.

The charts visually confirm the importance of the industry mix regarding the trend of inflation. The money supply does not affect those cross-sectional variations of inflation. From the investors’ standpoint, those sectoral pictures of inflation can be so useful that it will lead to many types of long-term ideas or strategies by regions, sectors, or products/services.

If we assume energy price flat or neutral due to its uncertainty, the potential sources of faster inflation (and thus the continuous rate increase cycle) can only be possible by either a revival of physical goods or by even more rapid inflation high-value-added services such as education and healthcare.

The latter scenario looks quite tricky as both the education and healthcare industry have raised too many eyebrows about the inflationary cost, which is a significant obstacle to universal access regardless of income and living status.

The politicians have identified them, and clearly, the price that users will pay in the future would develop differently. For instance, a student loan is the fastest-growing consumer loan, exceeding $1.2 trillion in the US for the inflationary college tuition. Healthcare insurance premium is becoming a significant issue for employers and employees. More and more innovative but expensive new drugs are getting approved and becoming available for cancers and other critical treatments that extend the life and treat rare diseases of young patients; otherwise, there are no other treatments.

One of the presidential candidates is proposing a plan to curve the rising cost of a drug. While this plan was announced after the mismanagement of EpiPen’s pricing, this issue is a broad indication of (un)sustainability of price increase without drug productivity increase. Obamacare has expanded healthcare coverage, which should be accompanied by the value of healthcare as a public service. The cost and price of the drug (and healthcare) will continue to get influenced by such a shift.

Interestingly, inflation may be getting under more control by the plans of the new US president. College tuition and student loan are also on the list. They are more effective in lowering inflation expectations than a FED rate hike. The shift of spending toward service, including healthcare from manufacturing, keeps the upward price trend to a certain extent.

Valuation and Inflation

For the market price valuation, what does the backdrop of the inflation trend we have seen imply to the current FCF and the yield spread?

The short answer is it supports the valuation.

While there are views that the tightening cycle is starting, we do not think it will be a structurally sustainable move, unless we assume the reversal of goods disinflation or the further rise in college tuition.

Also, inflation and growth have been gradually slowing since the mid-80s. We have not touched on how we should read it and view the next long-term trend, which will be a future topic of the articles we publish.

Meanwhile, corporates manage cash earnings very well after the financial crisis, despite low growth, but it contributed to tame risks of excess financial leverage in the system.

All of them are the new reality of the economy. Growth is getting slower, and it is so moderate that some feel stagnated and frustrated, leading to rising geopolitical & social-divide risks. However, it is just the result of the secular and steady workings of the wheels of the economy. The valuation is not at significant risk because most seem to believe things differently than we do.

Macroeconomic perspectives treat inflation not as the aggregate of different small fragmented dynamics, but as the pure monetary phenomenon.

The monetarist has made extreme an abstracted simplification of the real microeconomic dynamic events, and it suits to explain how the currency can get broken (i.e. extremely high inflation due to currency) but it looks to me just one extreme case of many.